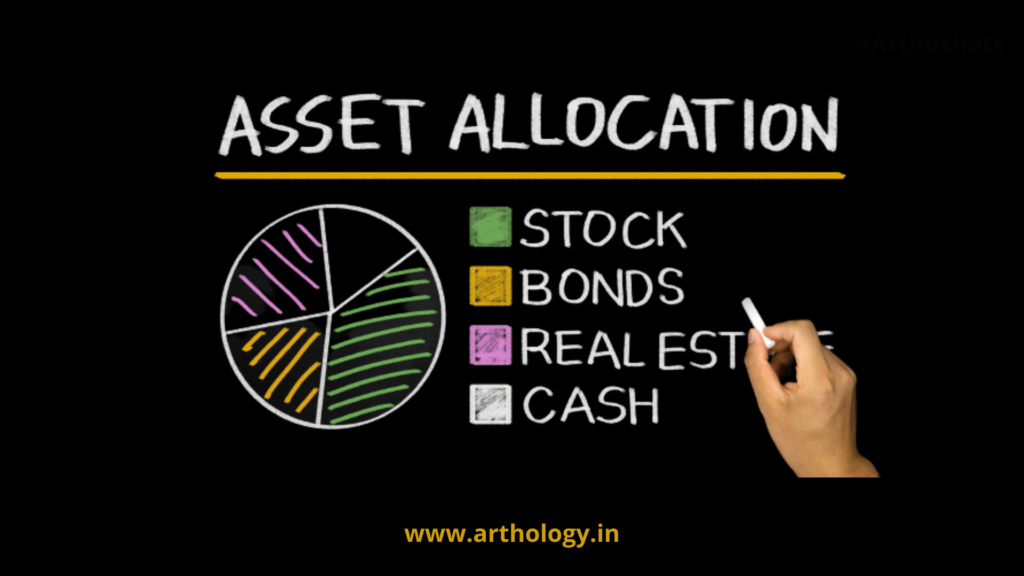

Asset allocation is simply investing your funds in different sorts of asset classes such as equities, debt, physical assets such as gold and real estate, cryptocurrencies, etc.

If one has to maximize his return on investments then the allocation of assets is a very important approach which he/she will use.

Asset allocation is quite a subjective and dynamic concept that fits differently to different age groups. New age investors and working population up to the of 35 have to satisfy their regular needs through savings and also have to secure funds for their and family’s future.

Sound asset allocation is the most effective approach to building wealth. Furthermore, prudent asset allocation entails diversifying one’s investments among unrelated asset types.

Stocks and fixed deposits (FDs), for example, have zero correlation, meaning that when stock prices rise or fall, FD rates do not rise or fall in lockstep. As a result, both of these asset classes must be included in your portfolio. In order to invest in fixed deposits, you need to look out for better options. E.g. FD in Bajaj Finance gives you a return of 6.75% at present.

New age investors in the age group of 20-35 can have higher exposure to asset classes which are comparatively in a high-risk high return category.

A good asset allocation –

Equities – 50-60%

Debt – 10-20%

Physical Assets & Real estate – 10-20%

Cryptocurrencies – 0-5%

Such kind of diversification by using different asset classes as mentioned above can reduce your total risk by deploying funds to assets with no or lesser correlation with each other.

Investors need to study their individual financial goals and needs. It helps in making informed decisions regarding the right asset allocation strategy.

Don’t miss an update, subscribe to our newsletter on telegram

Click Here to join.

Read our previous Artho shots here.