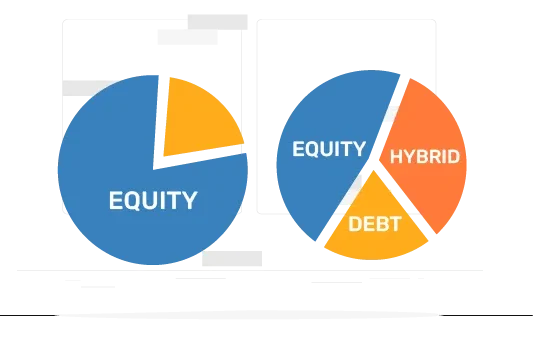

Pure equity vs asset allocation in India shapes how investors build wealth. Pure equity focuses solely on stocks or equity funds, while asset allocation diversifies across equities, debt, and more. With mutual fund AUM at ₹65.74 lakh crore in 2025, per AMFI, choosing the right strategy is key. Which suits you? Let’s break it down.

Pure Equity: High Risk, High Reward

In the pure equity vs asset allocation in India debate, pure equity means investing 100% in stocks or equity mutual funds like flexi-cap or large-cap funds. They deliver 12-14% annualized returns over a decade, per SEBI data, thus outpacing inflation. For example, ₹1 lakh in a Nifty 50 fund grew to ₹3.7 lakh in 10 years. However, volatility is steep—a 5% Nifty dip in 2024 hit portfolios, per IBEF. Pure equity suits risk-tolerant investors with 7+ year horizons.

Asset Allocation: Balanced Stability

Asset allocation, in pure equity vs asset allocation in India, spreads investments across equities, debt (bonds, FDs), gold, or real estate. A 60:30:10 equity-debt-gold mix balances risk, thus yielding 8-10%, per the Economic Times. Hybrid funds like ICICI Prudential Balanced Advantage adjust dynamically, cushioning market falls. In 2024, hybrid AUM hit ₹7.5 lakh crore, per AMFI. In addition, debt’s 6-8% returns and gold’s 6% stability offset equity swings, ideal for moderate risk-takers.

Risk, Returns, and Taxation

Pure equity vs asset allocation also differs in risk. Pure equity faces sharp market drops—mid-caps fell 10% in 2024’s FII sell-off, per IBEF. Asset allocation mitigates this via diversification; debt funds held steady in 2024, per AMFI. Taxation varies: equity funds face 20% short-term gains (under 1 year), 12.5% long-term (over ₹1.25 lakh); debt at slab rates, per SEBI. Moreover, asset allocation’s lower volatility suits shorter horizons, while equity chases higher long-term gains.

Which Strategy Should You Choose?

The choice between pure equity and asset allocation depends on several factors:

- Risk Tolerance: If you can withstand significant market fluctuations and have a long investment horizon, pure equity might also be suitable.

- Investment Goals: For long-term growth, equities are advantageous; for capital preservation and stable returns, asset allocation is thus preferable.

- Time Horizon: A longer investment horizon allows more time to recover from market downturns, making equities a viable option.

- Financial Situation: Assessing your current financial situation and future needs can help determine the appropriate strategy.

In India, where market volatility can be pronounced, many investors opt for a balanced approach, thus combining equities with other asset classes to achieve a harmonious blend of risk and return.

Conclusion:

In conclusion, pure equity vs asset allocation offers growth or balance—pick what aligns with your horizon. While pure equity investing offers the allure of higher returns, it comes with increased risk. Asset allocation provides a balanced approach, reducing volatility and offering downside protection. Ready to invest wisely? Explore more insights now!

– Ketaki Dandekar (Team Arthology)

Raed more about Pure Equity vs Asset Allocation here – https://www.bajajamc.com/equity-asset-allocation