Promoters and promoter groups are individuals or organizations that have a substantial impact on a firm. They may own a significant portion of the company, if not all of it, and they may also hold senior management roles. It is because of this double impact that investors must comprehend promoter holding and its ramifications.

Because of their dual role as substantial or largest investors in the company and as executives, analyzing changes in their holdings is vital and enlightening.

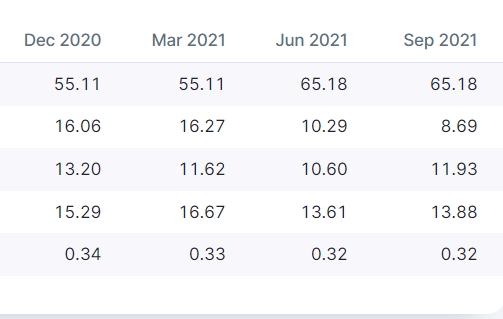

Even SEBI, the industry regulator, has stipulated that all promoters of publicly traded businesses must declare their holding pattern and commitments formed or discharged within seven days of such formation or discharge.

When promoters raise their stake in their companies in any way, it is usually regarded as a sign that the company will prosper in the future. The Securities and Exchange Board of India (Sebi) has taken a number of proactive steps to ease fund-raising regulations and make it simpler for businesses to raise capital in the aftermath of the Covid-19 crisis.

What does an increase in promoter holding indicate?

It’s the equivalent of putting one’s money where one’s mouth is. If major shareholders with a vested interest in the company, such as promoters, increase their investment, it suggests that they are optimistic about the company’s growth potential. They convince prospective investors to invest in the company’s shares by buying its shares, so boosting its price and, as a result, their wealth.

Anil Agarwal, the promoter of Vedanta, is a well-known example of a promoter buying shares in his company and the share price rising. In the fourth quarter of 2015, he raised his holdings. The average price of the purchase was around Rs 85 per share. The stock then touched 347 in December 2017. Even in current Financial year, promoters of Vedanta have raised their holding in the company.

What does a decrease in promoter holding indicate?

A drop in promoter holding, in contrast to an increase, conveys unfavorable signals to investors. It could mean that the company’s promoters aren’t confident in its prospects or don’t have a solid strategy for dealing with business rivalry. Given the promoters’ insider status, a reduction in their holdings deters potential investors from investing in the stock, resulting in a drop in the stock price.

What does low promoter holding mean?

While a low promoter holding may appear to be negative at first look, there are many other aspects to consider before fully discarding that stock. It’s a good sign if a stock has a low promoter holding but a high DII and FII holding.

A stock with a modest promoter holding that is increasing is also regarded as excellent. If you want to go deeper, try to figure out why promoter holding is so low. HDFC or Larsen and Toubro are two good examples. Both have a promoter holding of 0%. However, FII and DII holdings are relatively substantial.

Bottomline –

While promoter holding alone cannot determine whether or not a company is a good buy, it is certainly one of the aspects to consider. Furthermore, observing the decrease and increase in promoter holding is more valuable than observing the actual promoter holding.

Don’t miss an update, subscribe to our newsletter on telegram. Click here.

Read our previous Artho shots here.