Micro, Small, and Medium Enterprises (MSME) are businesses that produce goods and services. The Indian government enacted the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, which provides a variety of incentives to enterprises registered as MSME/SSI under the MSME Act.

MSME contributes significantly to our country’s socio-economic development. The Indian government has consistently backed small-scale companies and the unorganized business sector.

Classifications of MSME –

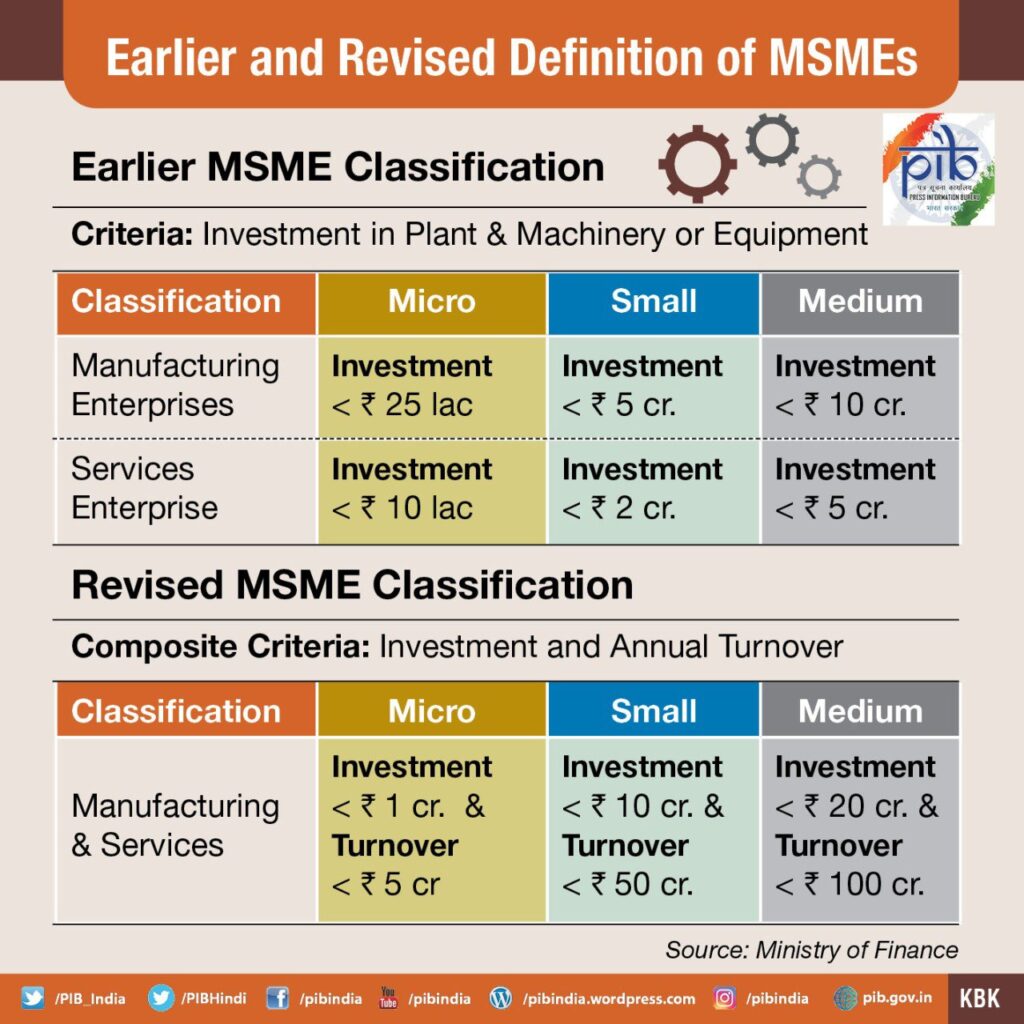

The earlier MSME classification was based on turnover and capital investment in plants and machinery. MSME was classified into two industries: manufacturing and service.

The Aatmanirbhar Bharat Abhiyan (ABA) introduced some improvements in the Ministry of Micro, Small, and Medium Enterprises in 2020. MSME classification criteria for investment in plant and machinery and yearly turnover have changed. There is no longer a distinction between the industrial and service industries.

Benefits of MSME Registration for Indians –

MSME Registration provides a lot of benefits to the business. Some of them are listed below.

- Collateral Free Bank Loans – All small and micro-business sectors in India now have access to collateral-free credit. This initiative provides funds to micro and small businesses. Benefits are available to both old as well as new businesses under this scheme. The GOI, SIDBI ), and the Ministry of MSME established the Credit Guarantee Trust Fund Scheme to ensure that the Credit Guarantee Scheme is implemented for all Micro and Small Enterprises.

- Concession on electricity Bills – MSME registereated entities are entitled to concessions on their electric bill. This helps businesses to boost their production and take in more orders without worrying about capital expenditure on costs like electricity and maintenance.

- Reimbursement of ISO certification charges – This motivates entrepreneurs to get their respective businesses ISO certified which helps them to do business abroad in terms of high-quality exports.

- Protection against delayed payments – The Supreme Court has mandated that any buyer of products or services from registered MSMEs make payment on or before the agreed-upon date of payment or within 15 days of accepting the goods or services. If the buyer delays payment for more than 45 days after receiving the products or services, the buyer must pay interest on the agreed-upon amount. The interest rate is three times higher than the rate announced by the Reserve Bank of India.

- Overdraft Interest Rate Exemption – Businesses and enterprises registered as MSMEs can avail a benefit of 1% on the OverDraft in a scheme that differs from bank to bank.

- Various Subsidies – There are various subsidies for which you can apply if you are a registered MSME.

Contacts us for any help – contactarthology@gmail.com

Don’t miss an update, subscribe to our newsletter on telegram. Click here.

Read our previous Artho shots here.