In the stock market, gaps are common occurrences that can signal important trends and potential price movements. One type of gap that traders and investors pay close attention to is the exhaustion gap. Understanding exhaustion gaps can help investors make better decisions, especially when it comes to entering or exiting trades.

What is an Exhaustion Gap?

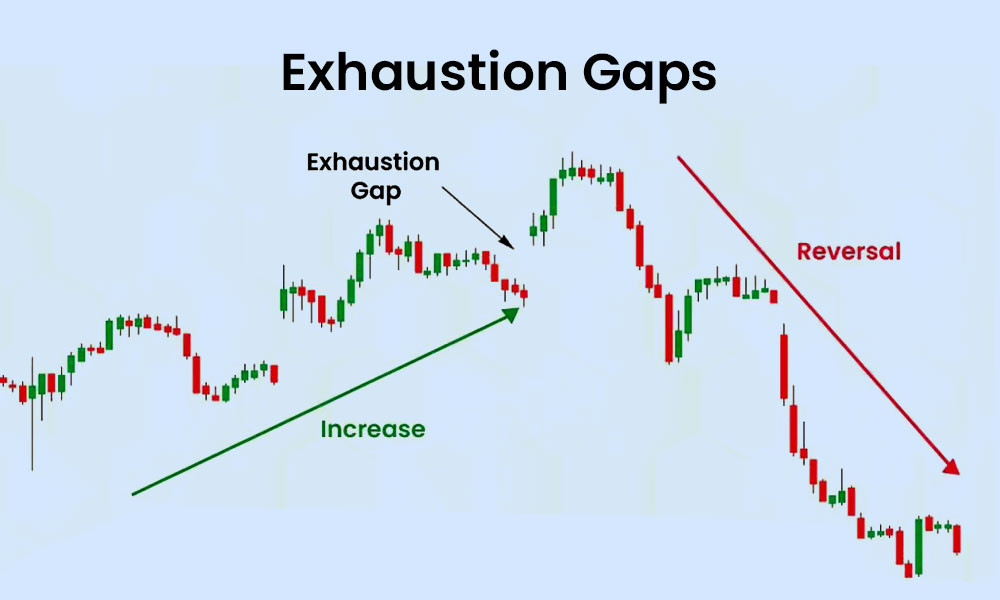

An exhaustion gap is a type of price gap that typically appears near the end of a strong price trend. It signals that the trend is losing momentum and may be about to reverse. It occurs when there is a sudden, sharp price movement at the beginning of a trading session, with no trading in between. This gap can be caused by a final surge of buying or selling activity, often driven by emotions like panic or excitement.

These gaps often happen after a prolonged uptrend or downtrend, where investors or traders become overly optimistic or pessimistic. When this surge of activity occurs, it can push the price beyond a key level, such as a resistance or support point. However, this movement is usually unsustainable, as the market is overextended and the buying or selling pressure fades quickly.

How to Spot an Exhaustion Gap:

To spot an exhaustion gap, investors typically look for these signs:

- Trend Length: The stock should have been in a strong uptrend or downtrend for an extended period before the gap occurs.

- Volume Surge: High trading volume during the gap helps confirm that this is the final attempt to move the stock.

- Gap Direction: In an uptrend, the exhaustion gap will be upward (gap up), and in a downtrend, it will be downward (gap down).

- Price Reversal: After the gap, the stock price tends to reverse direction and moves against the trend.

Example of an Exhaustion Gap:

Imagine a stock that has been in a strong uptrend for several weeks, with consistent gains. One morning, the stock opens much higher than the previous day’s close, creating an exhaustion gap. This sudden price surge is the result of a final burst of buying from traders who believe the stock will continue its climb.

However, after the gap forms, the stock starts to lose momentum. The buying pressure that drove the price higher starts to fade, and sellers begin to take over, leading to a sharp price reversal. The exhaustion gap, therefore, marks the end of the upward trend and the beginning of a downward correction.

Why Do Exhaustion Gaps Matter?

Exhaustion gaps matter because they can help traders predict a potential trend reversal. By identifying these gaps early, traders can avoid making poor investment decisions, such as buying into an overextended uptrend or selling into a downtrend that is about to end.

Moreover, these gaps are often seen as a signal of shifting market sentiment. When the trend shows signs of exhaustion, it can indicate that investors are becoming uncertain or less optimistic. Understanding this change is critical to making timely decisions in the market.

Conclusion:

Exhaustion gaps are valuable signals for traders who want to catch trend reversals. These gaps happen at the tail end of a trend and signal that the market is ready to change direction. By recognizing exhaustion gaps, traders can avoid getting caught in the tail end of a trend and position themselves to profit from the upcoming reversal.

– Ketaki Dandekar (Team Arthology)

Read more about Exhaustion Gap here – https://www.investopedia.com/exhaustiongap.asp.